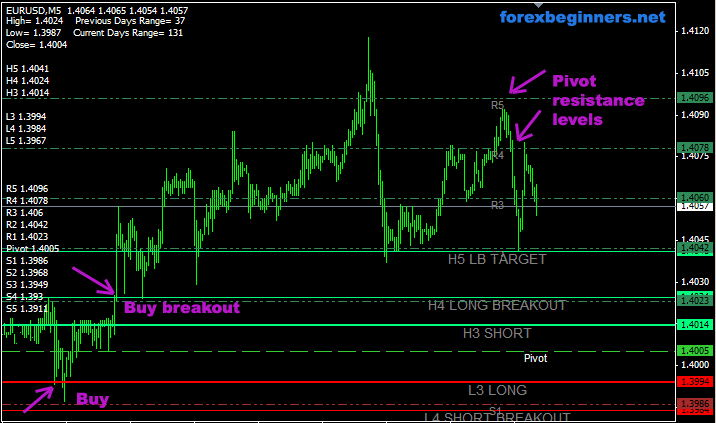

Forex Camarilla Equation Levels

The Camarilla Equation in Forex calculates eight levels of intra-day support and resistance according to yesterday's High, Low, Open and Close. There are 5 of these "L" levels below yesterday's close, and 5 "H" levels above. They are numbered L1, L2, L3, L4 and L5 etc.

The most important levels are L3, H3 levels and L4, H4 levels.

The main way to use Camarilla equation in Forex is to wait for price to approach L3. When price does so, traders expect market to reverse at L3 and H3 level and so they open positions against a trend and place protective stop loss outside closest L4 or H4 level.

Stop level at L4/H4 is only a suggested stop, you'll learn why below, traders are encouraged to find their own stops according to the money management rules and risk appetite.

Should one immediately place an order once price hits L3/H3 level? Yes, if you trade aggressively, No, if you like to see confirmation first. For confirmation price have to hit L3/H3 level, find support or resistance there and clearly demonstrate an intention to reverse. Traders may want to learn about reversal candlestick formation patterns in order to be able to spot a confirmation of a turning market.

The second way to trade Forex with the Camarilla Equation is to look at L4/H4 levels to be breached, which would signal of a breakout trade setup and allowing traders trade breakout in the direction of a trend. For, example, if price pushes up through the higher L4/H4 level, the chances are it is going to keep on running that way. Breakout trading outside L4/H4 level expects to capture sharp directional market moves.

While running with the breakout outside L4/H4, use either suggested L5/H5 level or your own target.

Trading Forex with the Camarilla Equation

After setting Camarilla levels on the charts, traders look at where the market has opened regarding the levels.

Market Open INSIDE L3/H3

If the market opens inside the L3/H3 levels, you must wait for price to approach either of these two levels. Whichever it hits first determines a trade: if the higher H3 is hit, Short against the trend in the

expectation that the market is going to reverse. Initial S/L above H4.

The opposite, applies when the Lower L3 level is hit first - go Long against the trend. Set S/L below L4.

Market Open OUTSIDE L3/H3

In this case, you wait for the market to retreat back through the L3/H3 level - you will then be trading with the trend, and once again, the L4/H4 levels act as you Stop loss.

Taking profits is a matter of personal judgment - just be aware that you

WILL want to take profits at some time during the day, because the market is unlikely to "behave" and stay right-sided for your trade. These reversals from L3/H3 appear to happen as often as 4 times out of 5 during intra-day trading.

Camarilla combined with Pivot Points

On the sreenshot above you may have also noticed a white Pivot line and the beauty of price reversal at it. You may use both Camarilla levels and Pivot levels to achieve better trading results.

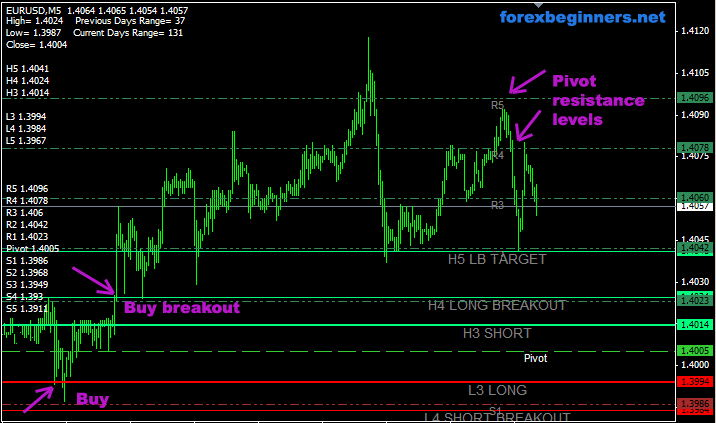

The Camarilla Equation in Forex calculates eight levels of intra-day support and resistance according to yesterday's High, Low, Open and Close. There are 5 of these "L" levels below yesterday's close, and 5 "H" levels above. They are numbered L1, L2, L3, L4 and L5 etc.

The most important levels are L3, H3 levels and L4, H4 levels.

The main way to use Camarilla equation in Forex is to wait for price to approach L3. When price does so, traders expect market to reverse at L3 and H3 level and so they open positions against a trend and place protective stop loss outside closest L4 or H4 level.

Stop level at L4/H4 is only a suggested stop, you'll learn why below, traders are encouraged to find their own stops according to the money management rules and risk appetite.

Should one immediately place an order once price hits L3/H3 level? Yes, if you trade aggressively, No, if you like to see confirmation first. For confirmation price have to hit L3/H3 level, find support or resistance there and clearly demonstrate an intention to reverse. Traders may want to learn about reversal candlestick formation patterns in order to be able to spot a confirmation of a turning market.

The second way to trade Forex with the Camarilla Equation is to look at L4/H4 levels to be breached, which would signal of a breakout trade setup and allowing traders trade breakout in the direction of a trend. For, example, if price pushes up through the higher L4/H4 level, the chances are it is going to keep on running that way. Breakout trading outside L4/H4 level expects to capture sharp directional market moves.

While running with the breakout outside L4/H4, use either suggested L5/H5 level or your own target.

Trading Forex with the Camarilla Equation

After setting Camarilla levels on the charts, traders look at where the market has opened regarding the levels.

Market Open INSIDE L3/H3

If the market opens inside the L3/H3 levels, you must wait for price to approach either of these two levels. Whichever it hits first determines a trade: if the higher H3 is hit, Short against the trend in the

expectation that the market is going to reverse. Initial S/L above H4.

The opposite, applies when the Lower L3 level is hit first - go Long against the trend. Set S/L below L4.

Market Open OUTSIDE L3/H3

In this case, you wait for the market to retreat back through the L3/H3 level - you will then be trading with the trend, and once again, the L4/H4 levels act as you Stop loss.

Taking profits is a matter of personal judgment - just be aware that you

WILL want to take profits at some time during the day, because the market is unlikely to "behave" and stay right-sided for your trade. These reversals from L3/H3 appear to happen as often as 4 times out of 5 during intra-day trading.

Camarilla combined with Pivot Points

On the sreenshot above you may have also noticed a white Pivot line and the beauty of price reversal at it. You may use both Camarilla levels and Pivot levels to achieve better trading results.